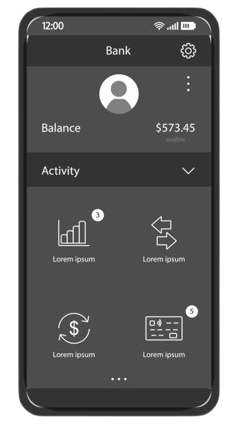

Pay bills, schedule recurring payments, and transfer funds between accounts easily.

Enrolling in digital banking is simple. Visit our website or download our mobile app, then click on ‘Enroll Now.’ You’ll need your account number, Social Security Number, and a valid email address to complete the enrollment process.

Yes, our mobile banking app uses bank-grade security, including 256-bit encryption, multi-factor authentication, and biometric login options. We also employ continuous monitoring for suspicious activities and automatically log you out after periods of inactivity.